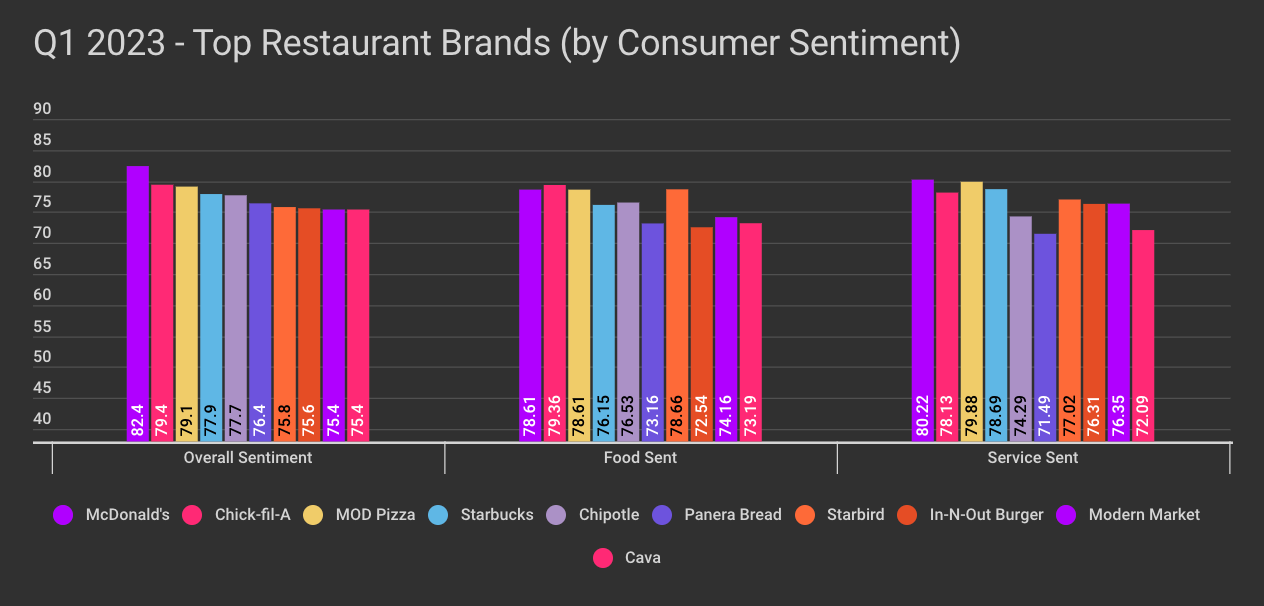

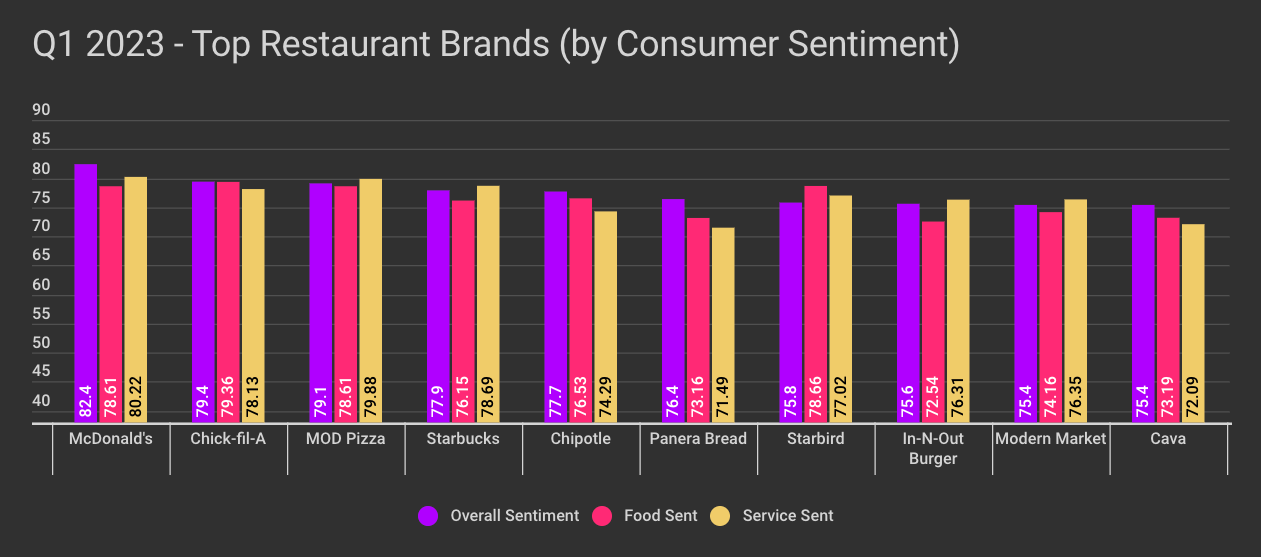

Top 10 Brands Based On Consumer Sentiment in 2023

Mcdonald's, Starbucks and Chipotle are usual suspects, it's the others that aren't

McDonald's Invades Fast Casual

McDonald’s reported that more U.S. consumers are flocking to its restaurants as inflation-weary Americans trade down from full-service restaurants to less-expensive alternatives, reports CNBC. For the second quarter in a row, the fast-food giant saw increased traffic at its U.S. stores, bucking the industry trend of consumers cutting back on dining out. The big sector MCD is swiping from is Fast Casual, with 38.6% of these guests dining more at QSR and McDonald’s.

The company reported a net sales decrease of 1% to $5.93 billion but an increase of 5% when removing foreign currency changes. Globally, same-store sales were up 12.6% in the quarter, visits were up 8.6%, and consumer sentiment has started an up trend once again since the high in May of 2022. The performance is fueled by strong demand in the United States and the fast-food chain’s largest European markets.

Executives expect a “mild to moderate” recession in the U.S. and a “deeper and longer” downturn in Europe, and he believes short-term inflation will continue in 2023. However, executives said inflation in the U.S. has likely peaked.

Starbucks Entering a New Zone of Innovation

Starbucks unveiled Starbucks Odyssey, a new experience powered by Web3 technology that will offer Starbucks Rewards members and partners (employees) in the United States the opportunity to earn and purchase digital collectible assets that will unlock access to new benefits and immersive coffee experiences. Starbucks is one of the first companies to integrate non-fungible tokens (NFTs) with an industry-leading loyalty program at scale while creating a digital community that will enable new ways for Starbucks to engage with its members and its partners.

This moves sets a new standard for how Web3 will be integrated into brand and culture with the element of loyalty as we see a new emergence of a digital ID that the blockchain will foster.

Our Restaurant Power Index Ranking will be delivered frequently throughout the year with quarterly updates and individual brand analysis on the twelve markers in the index centered around the overall brand, food, and service sentiment. Each brand is weighted in data by their guest traction so that smaller brands can make it into the rankings and our analysis from time to time. The consumer community is the key to registering these data points.