Economic Impact on Restaurant Growth

The restaurant industry, a cornerstone of the U.S. economy, is grappling with significant challenges in 2025 due to escalating tariffs and trade tensions, particularly with China. These developments have far-reaching implications for chain and independent restaurants and consumers who are increasingly sensitive to price changes.

The Role of Imports in Food Services

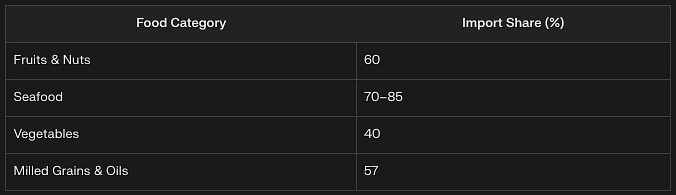

The restaurant sector relies heavily on imported goods. Nearly 20% of the nation's food supply is sourced internationally, with key trading partners such as Mexico, Canada, and China providing a substantial share of fruits, vegetables, seafood, and other staples. For instance:

Fruits and Nuts: 60% of U.S. consumption is imported.

Seafood: 70–85% of domestic consumption is sourced internationally.

Vegetables: Imports account for 40% of consumption.

The imposition of tariffs—ranging from 25% on imports from Mexico and Canada to an effective 145% on Chinese goods—has driven up costs for these essential items. This increase directly affects restaurant operators, who must either absorb the higher costs or pass them on to consumers through price hikes.

Consumer Pushback on Rising Prices

Price sensitivity among consumers has become a critical issue for the restaurant industry. Inflationary pressures have already led to menu price increases across the board:

Full-service restaurant prices rose by 3.6% in 2024.

Limited-service establishments saw a similar increase of 3.7%.

However, consumer pushback is mounting. Surveys reveal that over half of diners perceive fast-food prices as unfair, and many are cutting back on dining out altogether. In Q3 2024, 55% of U.S. adults reported spending less on eating out, with a growing preference for home-cooked meals or value-focused dining options. This shift underscores the delicate balance restaurants must maintain between pricing strategies and customer retention.

#1 rated HR platform for payroll, benefits, and more

With Gusto’s easy-to-use platform, you can empower your people and push your business forward. See why over 400,000 businesses choose Gusto.

Impact on Chains vs. Independents

The effects of tariffs are unevenly distributed across the restaurant landscape:

Chains: Large chains like Chipotle have the financial resources to absorb some tariff-related costs temporarily. For example, Chipotle sources only 2% of its ingredients from Mexico and less than 0.5% from Canada and China, allowing it to mitigate some impacts. However, prolonged cost increases could still force price adjustments.

Independents: Smaller independent restaurants face greater challenges due to their limited purchasing power and narrower profit margins. Many are already struggling with rising food and labor costs, which accounted for significant operational challenges in 2024.

Oil Prices and Inflation: A Silver Lining?

Amid these challenges, there are glimmers of hope. Oil prices have declined recently, which could reduce transportation costs for food supplies. Inflation has shown signs of easing; the Consumer Price Index (CPI) rose by just 2.4% in March 2025, down from its peak during the pandemic era. However, economists warn that tariffs could reverse this progress by increasing imported goods' prices.

Will the Fed Lower Rates?

The Federal Reserve's stance on interest rates remains a critical factor for economic expansion in the restaurant industry. Despite slowing inflation, the Fed is unlikely to cut rates in 2025 due to concerns about tariff-induced inflationary pressures. Morgan Stanley predicts no rate cuts this year, citing stagflation risks—high inflation coupled with slow growth—as a key concern.

Predictions and Strategies

Given these dynamics, here's what lies ahead for the restaurant industry:

Price Adjustments: Restaurants will likely continue raising menu prices modestly to offset rising costs while exploring value-driven offerings like bundled deals or loyalty programs to retain customers.

Operational Efficiency: Chains and independents alike will need to adopt cost-saving measures such as tech-driven inventory management and menu optimization.

Consumer Behavior: Diners will increasingly prioritize affordability, leading to higher demand for takeout options and home-cooked meals.

Chart: Food Imports as a Share of U.S. Consumption

The restaurant industry may be facing the worst summer in history as tariffs reshape supply chains and consumer behavior evolves in response to rising prices. While lower oil prices and easing inflation offer some relief, the broader economic environment—marked by high tariffs and stagnant interest rates—will require both chains and independents to innovate and adapt to survive in this new landscape.