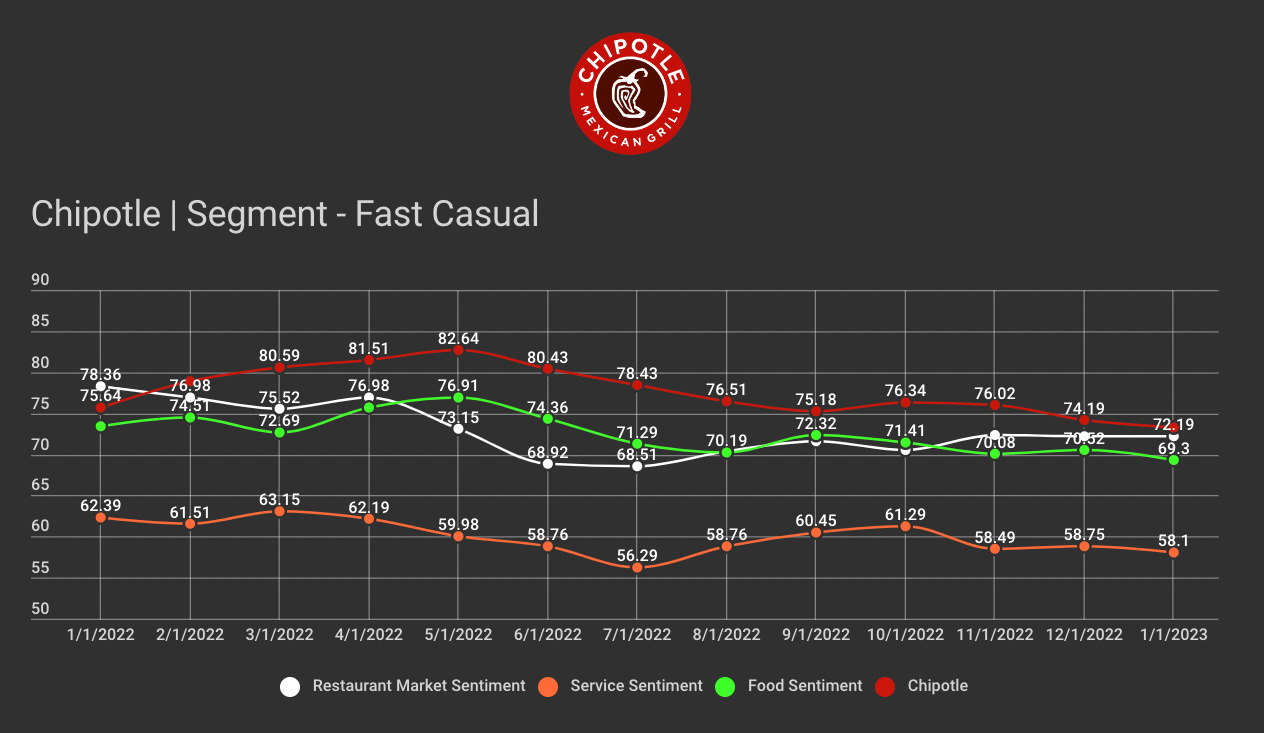

The latest Restaurant Power Index Sentiment data shows more trouble for the brand in relation to price and food quality. Twelve markers make up the RPI data published here on Foodable Pro.

New research suggests that restaurant pricing has begun to slow in the overall market. Limited-service menus rose 0.5 percent in December, while full-service ticked up 0.1 percent. The numbers were 6.6 and 8.2 percent higher, year-over-year, but a visible crawl compared to 2021’s month-to-month surges. More than anything, though, prices appear to have approached a ceiling in consumer sentiment and pushback.

In Q4 2022, according to Revenue Management Solutions, traffic across the quick-service industry declined 4.2 percent versus the prior-year period. Net sales were 6.1 percent higher, yet on the shoulders of average price rising 16.2 percent. The average check was also up 10.7 percent. Quantity per transaction decreased by 4.8 percent.